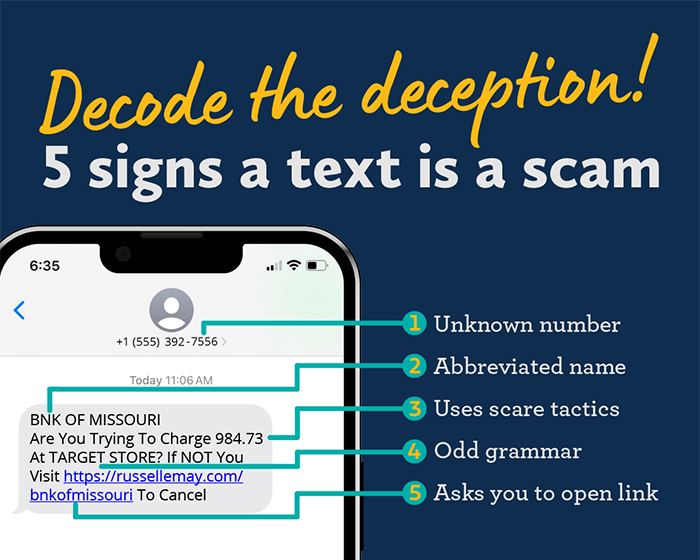

Scammers are increasingly sending out fake text messages posing as banks. To protect yourself, it’s crucial to recognize these five signs of a scam.

When you receive an unknown text, it’s time to put on your detective hat. A bank text scam can often look like a real text message from your bank. These imposters may text you about a bank warning or fraud alert. In other cases, the text might be about an unauthorized charge on your account.

While some of these texts may be easy to spot, others can look very convincing. These messages are designed to trick you into sending confidential information or money. Stop and think before you respond or click on a link. Remember The Bank of Missouri will never text, email or call you asking for your personal or account info. Nor will we ask you to send money to avoid a fraud event. If you’re ever in doubt, reach out to our team directly to make sure the message is valid.

Sign #1 - Unknown number

In most cases, texts from an unknown number should raise a red flag. Especially if you receive the text out of the blue and don’t have prior text history with that number. Before taking any action, check to see if that’s the number your bank usually uses to send text messages.

Even when you get a text from a recognized number, don’t automatically assume it’s safe. Still review the content to be sure, be suspicious of links and if in doubt, always ask.

Take these steps to be safer with unknown numbers:

- Verify the text numbers your bank uses and save those in your contacts.

- Do not reply to wrong number texts. A wrong number message is usually a scam, even when it doesn’t seem like it. It may say something as simple as “Hope to see you there at 3.” These are designed to get you talking until you feel comfortable enough to give up info. Even if you shut the conversation down right away, you’re likely to get more spam texts and calls afterward from other numbers. That’s because you’ve confirmed they reached a valid number.

- Be wary of messages from a number you’ve never received a message from before. Especially, if you didn’t specifically just sign up for text messages from that company.

- When in doubt, call a business to verify. Use a phone number you know is valid for that company. Don’t use the number shared in the text message, but rather go to that company’s website to get the number.

Sign #2 - Abbreviated name

Sometimes scammers abbreviate company names or even get them outright wrong. It’s one more thing to watch for as you try to keep your money and info safe.

Sign #3 - Uses scare tactics

When someone asks you to take an urgent action and something bad will happen if you don’t act right away, that’s another red flag.

You do not ever have to act quickly. Always take a minute to stop and evaluate the text. You owe it to yourself, and no one deserves your immediate response. Do the work to confirm if the text is valid first.

Scammers create a false sense of urgency to trip you up. And, they can be convincing. “Act now to secure your bank account” can sound pretty scary. Don’t fall for it!

Sign #4 - Odd grammar

It’s common to see grammar that is a little off in scam texts. Going back to the example at the top, it asks if you made a purchase at “Target store.” Odd, right? You don’t have to be an English teacher here. You’ll often spot missing or incorrect words and spelling mistakes pretty quickly. Perfect grammar doesn’t mean a message is safe, but poor grammar is definitely a clue to a scam.

Sign #5 – Asks you to open a link

We cannot overstate enough the risks of visiting links from texts. A scammer’s main goal is to get access to your money or sensitive information. Links are a key tool they use. They hope to capture your log in or other info in a couple of ways here.

- They tell you to click on a link to learn more about the issue. The link takes you to a spoofed website that looks real but isn’t. You enter your online banking username and password on their fake site. Then they take that data to your bank’s real site and wipe your account out.

- Or the link may install malware. Even if you don’t enter any info at their link, simply visiting an unknown link is risky. Criminals can use malware that is automatically downloaded to your device without your knowledge. Then, it records your personal or financial information data as you enter it across the web.

Banks rarely, if ever, send links via text. So your best bet is don’t click them. Always go directly to your bank’s website or use their official mobile banking app to log in.

Keep in mind, criminals may simply try to get this info from you in a text reply, no link needed. They may say they just need your log in info in order to take care of an issue with your bank account. Or you can make money if you give them your credit card number or send them money orders or gift cards. They may even pretend to be a family member in need. The reality is, scammers are convincing. And, will go to extreme lengths to get you to fall for their tricks.

We’re committed to helping you spot scams. Because when you know something sounds suspicious, you can stop criminals in their tracks. If you receive a text claiming to be The Bank of Missouri, it’s always best to stop and think. Don’t click a link, give them your info, or even respond. And if you feel unsure about a text, call us at 888-547-6541 to verify or report any concerns.